Discover Benefits, News, & More

Helping REALTORS® Take Their Business To The Next Level

For over a hundred years we have been helping REALTORS® transform their businesses from where they are to where they want to be. The Greater San Diego Association of REALTORS® is your trusted partner and truly dedicated to helping you succeed.

News & Press Releases

ReCoverCA Homebuyer Assistance Program Flood Recovery Funds Still Available – Now Easier to Access

Up to $300,000 in Forgivable Loans Help Households Living in Qualifying Flood Areas Purchase Homes in Safer, More Resilient Locations

California – January 28, 2026 – The ReCoverCA Homebuyer Assistance (HBA) Program continues to provide up to $300,000 in forgivable loans to help Californians who were renting in designated flood- affected areas during the 2023 or 2024 floods, purchase homes in safer, more resilient communities. Effective January 12, 2026, applicants are no longer required to provide documentation of direct flood impact, making it easier for more households to apply. Applicants must still have rented in a qualifying disaster area at the time of the flood event.

The financial assistance is offered as a Second Mortgage Loan, forgiven after five years of continued ownership and occupancy. Funds may be applied toward the down payment and closing costs, helping families bridge the gap between a First Mortgage Loan and the purchase price of an eligible home.

Designated Qualifying Disaster Areas include:

2023 Floods: Hoopa Valley Tribe (Humboldt County, ZIP 95546), Monterey, San Benito, Santa Cruz, Tulare, and Tuolumne Counties

2024 Floods: San Diego County

Eligibility highlights include:

Household income capped at 80% of Area Median Income (AMI)

First-time homebuyer status (no homeownership in past 3 years, with limited exceptions)

Home purchased must be in California, outside a FEMA-designated Special Flood Hazard Area

CalFire-designated High/Very High Fire Hazard Severity Zones

The ReCoverCA HBA Program is administered by the California Department of Housing and Community Development, funded by HUD, and managed by the Golden State Finance Authority (GSFA). Since its launch in June 2024, the program has helped more than 100 families become homeowners. For full program policies, eligibility, and application information, visit: www.gsfahome.org/recoverca-hba

About Golden State Finance Authority (GSFA)

GSFA is a local government entity and public agency, established in 1993, with a mission to provide affordable housing finance programs that support homeownership and strengthen California communities. GSFA has helped more than 87,000 individuals and families purchase homes, providing over $683.3 million in down payment assistance.

For more information, contact:

Carolyn Sunseri

(855) 740-8422

[email protected]

Homeowners May Qualify for City Subsidy to Offset New Trash Collection Fees

Source: David Garrick Union-Tribune

SAN DIEGO — The City of San Diego has launched a long-anticipated subsidy program to assist income-qualified homeowners with the city’s new trash collection fees. Applications are now open and will be awarded on a first-come, first-served basis to approximately 7,000 eligible households.

The new trash fees, which began following voter approval of Measure B in 2022, range from $32.82 to $43.60 per month, depending on trash bin size. While billed monthly, the fees are collected twice a year on property tax bills in December and April.

Through this program, qualifying homeowners may receive either a 50% subsidy or, in limited cases, a 100% subsidy toward their annual trash fee.

Eligibility Requirements

To qualify, applicants must:

Own and occupy the property as their primary residence

Have a total household income below 60% of the State Area Median Income, or

Have at least one household member enrolled in CalWORKs, Medi-Cal, CalFresh, or the Low Income Home Energy Assistance Program

For 2026, monthly income limits include:

$3,331 (1 person)

$4,356 (2 people)

$5,382 (3 people)

$6,407 (4 people)

$7,432 (5 people)

Most approved applicants will receive a 50% subsidy. Homeowners who are on a county payment plan for property taxes delinquent for more than one year may qualify for a full (100%) subsidy if all other criteria are met.

Program Administration & Funding

The program is administered by the Metropolitan Area Advisory Committee on Anti-Poverty of San Diego County (MAAC). Funding includes $3 million allocated by the City of San Diego in its annual budget, along with $60,000 in private donations.

City officials emphasized that the goal of the program is to prevent financial hardship for homeowners as the new fee is implemented.

“Supported by city leaders, strengthened by customer donations, and administered by a nonprofit with deep local knowledge, the program is designed to provide meaningful assistance while reaching as many qualifying households as possible,” said Jeremy Bauer, Assistant Director of the City’s Environmental Services Department.

How to Apply

Applications are being accepted online at:

MAACproject.org/SDSWAssistance

Homeowners may apply whether or not they have already paid part or all of the current year’s trash fee. Applications will be accepted through April, as long as funding remains available. Any remaining applications may be considered for future trash fees appearing on fall 2026 property tax bills.

In-Person Application Assistance

The City will also offer in-person assistance at community locations, including:

Logan Heights Library — Wednesday, 9:30 a.m. to 3:30 p.m. at 567 S. 28th Street

San Ysidro Library — February 4, 9:30 a.m. to 3:30 p.m. at 4235 Beyer Boulevard

For more information or assistance, residents may visit MAACproject.org/SDSWAssistance or call (619) 946-4419.

Ten Years of Housing Data Changes

Author: Dr. Jessica Lautz is the Deputy Chief Economist and Vice President of Research at the National Association of REALTORS®.

For REALTORS®, understanding long-term housing trends isn’t just informative—it’s a competitive advantage. A decade of housing data reveals how shifts in inventory, affordability, pricing, and buyer behavior have reshaped the market and continue to influence today’s transactions and client conversations.

This insight helps REALTORS® set expectations, guide buyers and sellers with confidence, and adapt their business strategies in a rapidly evolving landscape.

To explore how the housing market has changed over the last ten years—and what those changes mean for real estate professionals—read this analysis from the National Association of REALTORS: https://www.nar.realtor/blogs/economists-outlook/ten-years-of-housing-data-changes

Classes & Events

Classes

Jan. 24 - Mastering the Fundamentals of the MLS

Elevate your real estate expertise with "Mastering the Fundamentals of MLS," a class meticulously designed to turn the Multiple Listing Service into your most powerful tool. In this course, you'll unravel the complexities of MLS, learning to leverage its full potential to serve your clients effectively and efficiently. We'll cover the essentials of navigating listings, optimizing search strategies, and mastering the art of presenting data that captures attention. This isn't just about understanding a system; it's about transforming information into opportunities and using MLS insights to anticipate market trends.

Classes

Jan. 31 - Mastering the Fundamentals of the MLS

Elevate your real estate expertise with "Mastering the Fundamentals of MLS," a class meticulously designed to turn the Multiple Listing Service into your most powerful tool. In this course, you'll unravel the complexities of MLS, learning to leverage its full potential to serve your clients effectively and efficiently. We'll cover the essentials of navigating listings, optimizing search strategies, and mastering the art of presenting data that captures attention. This isn't just about understanding a system; it's about transforming information into opportunities and using MLS insights to anticipate market trends.

Classes

Jan. 31 - Dominando los Fundamentos de MLS (en Espanol)

Eleva tu experiencia en bienes raíces con “Dominando los Fundamentos de MLS”, una clase diseñada meticulosamente para convertir el Servicio de Listado Múltiple en tu herramienta más poderosa. En este curso, desentrañarás las complejidades de MLS, aprendiendo a aprovechar todo su potencial para servir a tus clientes de manera efectiva y eficiente. Cubriremos los aspectos esenciales para navegar entre los listados, optimizar estrategias de búsqueda y dominar el arte de presentar datos que capturan la atención. Esto no se trata solo de entender un sistema; se trata de transformar la información en oportunidades y usar las percepciones de MLS para anticipar las tendencias del mercado.

Classes

connect MLS Overview

Rather than tell you all about our latest exciting release, we thought it might be better to show you just how connectMLS enhancements help REALTORS®. Join one of our hourly demos to learn more about this top-rated MLS system with unlimited listing photos, mobile responsiveness for convenient access on any device with an additional suite of tools to efficiently collaborate with their clients.

Classes

The Buyer Representation & Broker Compensation Agreement (BRBC)

Once the BRE ( Buyer Representation Agreement) has now changed to BRBC (The Buyer Representation & Broker Compensation Agreement). Learn from Mike Shenkman, UCSD Professor, as he walks you through the many changes 2023 has brought to the real estate industry. Get in the know and protect yourself and your Buyer. Sign up today!

Classes

Pre-Recorded Video: connectMLS Demo

Rather than tell you all about our latest exciting release, we thought it might be better to show you just how connectMLS enhancements help REALTORS®. Join one of our hourly demos to learn more about this top-rated MLS system with unlimited listing photos, mobile responsiveness for convenient access on any device with an additional suite of tools to efficiently collaborate with their clients.

Classes

connectMLS Property Searches

This training will cover everything you need to customize your environment, access the system on any device, find helpful resources, and ask any questions you have.

Classes

New Member Orientation - Jul. 10

Are you a newly licensed real estate agent? If you are fresh out of real estate school, you are probably thrilled that you passed the test and found a great broker but have no idea what to do next! Join us for our live new member orientation at our Kearny Mesa office featuring training on what you need to know to get started, the benefits of your SDAR member products and services, and lunch provided by the top real estate affiliates.

Classes

3 Killer Listing Strategies - Tom Ferry Live Webinar: Aug. 1

Celebrated Real Estate Coach Tom Ferry presents “3 Simple Lead Gen Strategies (That Are Working Now!)” a dynamic live webinar that will expose you to three immediately actionable tactics to generate more listing leads in today’s uncertain market.

Classes

CRS One Day Course: Zero to 60 Home Sales a Year (and Beyond)

Do you dream of selling 60 homes or more per year, but aren't sure where to begin? Whether you are looking to jumpstart your business or just starting out, the RRC One Day Course, Zero to 60 Home Sales a Year (and Beyond) will help you accelerate your home sales and create a continuous flow of business. Learn new marketing methods that will help you position yourself as the REALTOR® of choice in your area. Join Matthew Rathbun, CRS is a Virginia licensed broker and executive vice president of Coldwell Banker Elite. He has served as an association director of education and president of Four Pillars Education. As a residential REALTOR®, Rathbun is a reoccurring high producer. Rathbun teaches a variety of national designation courses, broker-manager courses, and risk reduction programs. He also teaches regularly for Coldwell Banker Corporate and provides consulting services for one of the most innovative learning tools in the industry.

Classes

Sep. 14 - YouTube Content Strategy

As a real estate agent, it's important to have an effective YouTube content strategy in order to reach your target audience. You will learn about the best strategies for creating engaging visuals and informative videos that capture the attention of viewers, and hopefully lead to more client impact and lead generation.

Classes

Sep. 19 - Content Creation - Newsletters, Calls, and More!

As a real estate agent, building an engaged audience on social media is essential to gaining more leads and driving growth. With the right strategy and know-how, you can set yourself up for success in the ever-growing world of social media. This class covers topics like creating content that resonates with your followers, engaging with others online, leveraging hashtags to reach new audiences.

Classes

Sep, 22 - How to Engage Your Audience

As a real estate agent, building an engaged audience on social media is essential to gaining more leads and driving growth. With the right strategy and know-how, you can set yourself up for success in the ever-growing world of social media. This class covers topics like creating content that resonates with your followers, engaging with others online, leveraging hashtags to reach new audiences.

Classes

Essentials for New Agents - Series 1 of 6

This course covers everything from mastering the MLS and understanding the benefits of SDAR, to navigating contracts and managing conflicts, this class equips you with the foundational knowledge to thrive in the real estate world.

Classes

Sep. 25 - Top Notch Ads

As a real estate agent in the 21st century, you need to know what kind of ads are worth spending your money on and which ones aren't. Social media is an incredibly useful tool when it comes to advertising - but only if you use it correctly. This class will show you how to maximize your reach and make the most of your ad budget with top notch ads that will connect you to clients.

Classes

Sep 25 - Unlocking ADU Potential (Part 2)

Attend an engaging and comprehensive class on Accessory Dwelling Units (ADUs), presented by Lisa De Jesus of ADU Gurus. This special event will be held in two informative sessions this June, designed to provide you with the essential knowledge and tools to navigate the exciting opportunities in ADU development. Whether you are interested in adding value to single-family parcels or exploring multi-family options, our expert presenters will guide you through the latest legislative updates, building requirements, and strategic considerations. Attending both sessions is crucial to gain a complete understanding and make the most of this growing trend in California real estate. Don't miss this opportunity to expand your expertise and stay ahead in the market!

Classes

Essentials for New Agents - Series 2 of 6

This course covers everything from mastering the MLS and understanding the benefits of SDAR, to navigating contracts and managing conflicts, this class equips you with the foundational knowledge to thrive in the real estate world.

Classes

Sep 28 Webinar - ZipForm® Templates

See your real estate tools in action! This webinar covers the basics of zipForm® Plus, and how to create transactions and templates. Kevin Burke, JD, will walk you through the process, giving you the tools to customize your forms to suit your needs. Y

Classes

Sep. 29 - Social Media Training with Jason Pantana

Jason Pantana is a coach, trainer, and speaker for Tom Ferry International the world's leading real estate coaching program. His energetic style engages his audiences to utilize the ever-changing marketing tools of today.

Classes

New Member Orientation - Oct. 3

Are you a newly licensed real estate agent? If you are fresh out of real estate school, you are probably thrilled that you passed the test and found a great broker but have no idea what to do next! Join us for our live new member orientation at our Kearny Mesa office featuring training on what you need to know to get started, the benefits of your SDAR member products and services, and lunch provided by the top real estate affiliates.

Classes

Oct. 4 - Time Management

Learn how to build an effective strategy, create exciting content, and use the best practices for time management. From understanding your target audience to staying ahead of trends in the industry, this course will provide you with the tools needed to effectively market yourself online, while managing your time effectively as well.

Classes

Essentials for New Agents - Series 3 of 6

This course covers everything from mastering the MLS and understanding the benefits of SDAR, to navigating contracts and managing conflicts, this class equips you with the foundational knowledge to thrive in the real estate world.

Classes

Essentials for New Agents - Series 4 of 6

This course covers everything from mastering the MLS and understanding the benefits of SDAR, to navigating contracts and managing conflicts, this class equips you with the foundational knowledge to thrive in the real estate world.

Classes

Oct. 12 - The AI Age of Real Estate

AI tech veteran Ray Broemmelsiek and veteran Realtor Karen Van Ness, will present a lively point/counterpoint discussion on how the two disciplines cross paths. Learn how AI will change a real estate agent’s profession, increase their value and visibility, and automate their marketing. (module 2 of 4)

Classes

Essentials for New Agents - Series 5 of 6

This course covers everything from mastering the MLS and understanding the benefits of SDAR, to navigating contracts and managing conflicts, this class equips you with the foundational knowledge to thrive in the real estate world.

Classes

Essentials for New Agents - Series 6 of 6

This course covers everything from mastering the MLS and understanding the benefits of SDAR, to navigating contracts and managing conflicts, this class equips you with the foundational knowledge to thrive in the real estate world.

Classes

Oct. 19 - The AI Age of Real Estate

AI tech veteran Ray Broemmelsiek and veteran Realtor Karen Van Ness, will present a lively point/counterpoint discussion on how the two disciplines cross paths. Learn how AI will change a real estate agent’s profession, increase their value and visibility, and automate their marketing. (module 3 of 4)

Classes

Oct. 24 - CA Residential Purchase Agreement (Lunch & Learn)

The California Residential Purchase Agreement (RPA) form is the cornerstone of every successful real estate transaction in the state of California. There are several essential concepts, principles and facts about this form that all REALTORS® should know. Join UCSD professor Mike Shenkman as he covers detailed instructions on how to use the RPA form during this live, in-person training. Lunch will be served.

Classes

Oct. 26 Webinar - CRS Tax & Pre-Foreclosures

Learn how CRS Tax can put powerful, accurate data at your fingertips. Search properties throughout California, with cutting-edge technology that provides agents and brokers the tools needed to identify, understand, and act based on that data. In this webinar you will learn how to search for foreclosed properties.

Classes

Oct. 26 Webinar - Benefits Overview: MLS Rules

Real estate professionals depend on accurate and timely data to conduct their business successfully. That's why it's so important to enter and maintain listings in compliance with MLS Rules and Regulations. Contract expert Kevin Burke, JD, covers the "do's" and "don'ts" for listings on the service.

Classes

Oct. 26 - Presenting and Reviewing Offers

Increase your real estate knowledge by attending this class on presenting and reviewing offers. Mike Shenkman, UCSD professor, will provide you with the tools and skills needed to stay relevant and thrive in your real estate career. Join us for a live in-person class at the Kearny Mesa office.

Classes

Oct. 31 - Strategies to Win in 2024!

Join us for an enlightening webinar hosted by the esteemed Tom Ferry, as he delves into the pivotal topics of "What to Expect for 2024" and "Top Growth Strategies to Win in 2024." Gain invaluable insights as Tom unravels the anticipated challenges and changes of 2024, offering a clear foresight to navigate the evolving landscape. He will not only discuss what lies ahead but will also equip you with robust strategies to overcome these hurdles and ensure the continuous growth of your business. Don't miss this opportunity to future-proof your business and emerge victorious in the face of change, by learning actionable steps you can implement right now.

Classes

Oct. 31 Webinar - FastStats: Understand Your Market

Take a deep dive into housing market stats ! Join Kevin Burke JD., as he shows you how to use FastStats to understand the housing market better than ever before. As he demonstrates this great statistics tool, he'll talk about how to use the data for your business, with your clients, and as tools for marketing.

Classes

Nov 4 - New Member Orientation

Are you a newly licensed real estate agent? If you are fresh out of real estate school, you are probably thrilled that you passed the test and found a great broker, but have no idea what to do next! Join us for our live New Member Orientation at our Kearny Mesa office features training on what you need to know to get started, the benefits of your SDAR member products and services, and lunch provided by the top real estate affiliates.

Classes

New Member Orientation - Nov. 7

Are you a newly licensed real estate agent? If you are fresh out of real estate school, you are probably thrilled that you passed the test and found a great broker but have no idea what to do next! Join us for our live new member orientation at our Kearny Mesa office featuring training on what you need to know to get started, the benefits of your SDAR member products and services, and lunch provided by the top real estate affiliates.

Classes

Nov. 7 Webinar - Reading Preliminary Title Reports

Among the dozens of records that inform or disclose to the buyer significant knowledge about the property, the title report is one of the most important. In this webinar, Kevin Burke, JD, shows you how to read the preliminary title report.

Classes

Nov. 9 Webinar - Residential Listing Agreement

Next to the Purchase Agreement, the C.A.R. Residential Listing Agreement (Exclusive Right to Sell) is the most commonly used contract by REALTORS®. Join MIke Shenkman, UCSD professor, to learn the terms of this agreement and overcome the three common objections (commitment, price and commission) sellers have to signing the agreement.

Classes

Nov. 9 Webinar - Top 6 Disclosures

The real estate licensee has a duty to conduct a reasonably competent diligent visual inspection of the accessible areas of the property! Do you know what the Top 6 Disclosures are that should be in every file?

Classes

Nov. 14 Webinar - Property Mgmt. Forms

Learn how to manage your property management forms from the moment you acquire a new property. Join Mike Shenkman as he walks you through the most common agreements that all property managers will use.

Classes

Nov. 14 Webinar - Property Tax Explained: Prop. 13

In 1978, California voters overwhelmingly approved Proposition 13 in response to the dramatic increase in property tax. This proposition has received nationwide attention being the most famous and influential of California's ballot measures. Learn the history and impact of Proposition 13 with UCSD instructor, Mike Shenkman.

Classes

Nov. 14 Webinar - Creating zipForm® Templates

Ever wondered how you can speedily create a new transaction in zipForm®? Your client is in the conference room patiently waiting. There is an easy way to protect yourself and your client. In this webinar, learn how to create, copy, or even re-use transaction templates. Learn some of the tricks of the trade that will assure compliance on a number of levels!

Classes

Nov. 15 - San Diego 2024 Forecast

Steven Thomas from "Reports on Housing" will break down the housing market from 2023 and bring his key insights and data to forecast what's to come on the horizon in 2024. Steven and "Reports on Housing" have delivered local data and forecasting services across Southern California for years, and is looking forward to answering all your real estate questions, like: When will rates drop and improve affordability? When will more homes come on the market? Will there ever be more foreclosures? We hope you can make it to learn more about the San Diego County housing market and where it's headed in 2024!

Classes

Nov. 16 Webinar - Top 10 Risk Avoidance Techniques

REALTORS® are faced with countless interactions with the public throughout the course of their career. Are there "risks" associated with the business? Sure there are! But there are also ways to "mitigate" the risk. In this webinar you’ll go over the Top 10 risk avoidance techniques and hone your skills to help you better serve and protect yourself and your clients.

Classes

Nov. 16 Webinar - The Residential Purchase Agreement

The California Residential Purchase Agreement (RPA) form is the cornerstone of every successful real estate transaction in the state of California. There are several essential concepts, principles and facts about this form that all REALTORS® should know. Join UCSD professor Mike Shenkman as he covers detailed instructions on how to use the RPA form during this webinar.

Classes

Nov. 16 Webinar - Changes to the RPA

The California Association of REALTORS® issues 2023 updates of the standard Residential Purchase Agreement (RPA), the standard form used in the overwhelming majority of California home sales. Get detailed instructions on how to properly complete and use the RPA from an expert! Join Kevin Burke in this live webinar training.

Classes

Nov. 21 Webinar - NHS Pro: More Leads, Less Effort

This webinar addresses and shares a solution to the most critical residential real estate issue general real estate agents face: a shortage of resale listings and the need for salable inventory. Plan to leave with an idea (that you can use the same day) that may help you make a sale you would have missed.

Classes

Nov. 28 Webinar - Open House Success

Open houses are easy and can be quite rewarding. You just need a few simple steps to make them completely effective! Join Kevin Burke for this informative webinar.

Classes

Nov. 28 Webinar - Buyer Rep. and Broker Compensation

The BRE (Buyer Representation Agreement) has now changed to the BRBC (Buyer Representation & Broker Compensation Agreement). In this webinar, learn from Kevin Burke about this and other changes for the real estate industry. Get in the know and protect yourself and your buyer.

Classes

Nov. 30 Webinar - Maintaining Records: Reducing Risk

All real estate agents will find themselves buried under a mountain of contracts and disclosures. Join Kevin Burke as he covers the proper way to manage your real estate records. He will share with you the tips and tricks on how to maintain your records and avoid risk.

Classes

Nov. 30 - Ai-Powered Digital Domination in RE

Ready to supercharge your real estate and mortgage game with Artificial Intelligence (Ai)? Join this Google master class and discover how Ai-driving SEO, Google listings, and geo-tagging can boost your visibility. Use Ai to create SEO-friendly service descriptions, FAQs, and review responses. Held live in the classroom at SDAR's Kearny Mesa headquarters. Note: The deadline to sign up for this class is two days prior.

Classes

Nov. 30 Webinar - Property Mgmt - The Beginning

In this webinar, you will gain a deeper and broader understanding of the property management process, legal and contractual considerations, as well as best practices and expert tips for success. This course is ideal for REALTORS® who need a blueprint for starting a career as a professional property manager, and also for experienced property managers who are looking for tools and techniques to propel their business to the next level. Join Kevin Burke as he gives you an insightful look at the inner workings of property management

Classes

Oct. 31 Webinar - MLS Paragon: Collaboration Center

This training is recommended for new agents and agents new to the system. Join Kevin M. Burke,JD as he covers the basics of the Paragon MLS platform. You will also learn where to access MLS documents and resources to assist you when using the system.

Classes

Dec. 4 - Get Your BRBC Signed!

This is an essential class for real estate professionals focusing on the intricacies of the Buyer Representation Brokerage Contract (BRBC) in California, providing an in-depth understanding of the BRBC, currently a subject of litigation, and ensuring that participants are well-informed about the latest developments and legal nuances. As a service to our members, SDAR is committed to offering the most current information and strategies for effectively utilizing and getting the BRBC signed in today's dynamic real estate environment. Attendees will gain valuable insights and practical knowledge, empowering them to confidently navigate the complexities of the BRBC, enhancing their professionalism and success in the California real estate market.

Classes

Dec. 5 Webinar: All About Disclosures

In this "All About Disclosures" online course you will review approximately 30 disclosure requirements that are typically seen in a residential 1-4 transaction, item by item. The course will help you understand the reasons behind the disclosures, when the disclosures must be made, and when they might be exempted. Take this course to help better serve your buyers and sellers along with protecting yourself from personal liability.

Classes

New Member Orientation - Dec. 5

Are you a newly licensed real estate agent? If you are fresh out of real estate school, you are probably thrilled that you passed the test and found a great broker but have no idea what to do next! Join us for our live new member orientation at our Kearny Mesa office featuring training on what you need to know to get started, the benefits of your SDAR member products and services, and lunch provided by the top real estate affiliates.

Classes

Dec. 5 Webinar: TDS, SPQ, SPQA, AVID Disclosures

For REALTORS®, contracts and disclosures are the way to minimize risk and protect our clients and ourselves. Join this webinar to get a tutorial on these disclosures: TDS (Transfer Disclosure Statement), SPQ (Seller Property Questionnaire), as well the SPQ Addendum and the AVID (Agent Visual Inspection Disclosure).

Classes

Dec. 7 Webinar: Disclosures - Statutory vs. Contractual

REALTORS® are faced with countless contracts throughout the course of their career. These trainings are designed to inform, prepare and hone your skills to help you better serve and protect yourself and your clients. Kevin M. Burke, JD, keeps you in the loop with fast, easy and comprehensive real estate contract trainings

Classes

Dec. 7 - Buyer's Consultation

Dive into an enlightening California REALTOR® buyer's consultation, guided by a seasoned instructor. Harnessing the Tom Ferry approach to real estate, this session illuminates the art of understanding buyer needs, leveraging market insights, and crafting tailored strategies. Participants will be equipped with cutting-edge techniques to navigate the vibrant Californian property landscape. This consultation promises not only knowledge but also the confidence to secure the best deals for every buyer. Snacks and drinks will be provided. Seating is Limited. *Tom Ferry, himself will not be present.

Classes

Dec. 7 - Buyer's Consultation

Dive into an enlightening California REALTOR® buyer's consultation, guided by a seasoned instructor. Harnessing the Tom Ferry approach to real estate, this session illuminates the art of understanding buyer needs, leveraging market insights, and crafting tailored strategies. Participants will be equipped with cutting-edge techniques to navigate the vibrant Californian property landscape. This consultation promises not only knowledge but also the confidence to secure the best deals for every buyer. Snacks and drinks will be provided. Seating is Limited. *Tom Ferry, himself will not be present.

Classes

Dec. 7 Webinar - Master My Farm

Have you ever wondered how to REALLY be effective in Farming for your own leads? It is easier than you think if you just follow a few small steps. Learn from the professional who sold 40 homes in Del Mar in one year. Kevin Burke, JD, shows you how easy it is to take control of your marketing, turning passive into active marketing!

Classes

Dec. 12 Webinar - Winning Listing Presentations

Increase your real estate sales and profits by sharpening your skills. In this webinar you will gain the tools and skills needed to stay relevant and thrive in your real estate career. So you've received the call to pitch a prospective seller and sign your next big listing. What can you do to gain the greatest competitive advantage before you walk in the door? Join Kevin Burke as he walks you through creating a winning listing presentation.

Classes

Dec. 12 Webinar - Contracts New Forms

It's that time of the (twice a) year again: C.A.R. is coming out with their New & Revised Forms (Dec 2023). Remember, this means job security for those in the know. Get a quick summary of the "tools of your trade." The time to read the document for the first time is NOT when you are sitting in front of your client. You are authorized to explain the Standard Forms by virtue of having your real estate license. Learn the detailed, step-by-step principles behind explaining these necessary forms to your client.

Classes

Dec. 14 Webinar - Creating a Lease Template

Join Kevin M. Burke in this contracts webinar series, as he gives detailed instruction on how to properly use leasing forms, step-by-step, to better serve and protect yourself and your clients.

Classes

Dec. 14 Webinar: Creating the Ultimate Listing Agreement

Now, it's time to create the Ultimate Listing Agreement to "wow" your clients. Join Kevin Burke, JD. to learn all the tips and tricks on how manage your risk and win clients.

Classes

Dec. 17 - Mastering the Fundamentals of the MLS

Elevate your real estate expertise with "Mastering the Fundamentals of MLS," a class meticulously designed to turn the Multiple Listing Service into your most powerful tool. In this course, you'll unravel the complexities of MLS, learning to leverage its full potential to serve your clients effectively and efficiently. We'll cover the essentials of navigating listings, optimizing search strategies, and mastering the art of presenting data that captures attention. This isn't just about understanding a system; it's about transforming information into opportunities and using MLS insights to anticipate market trends.

Classes

Dec. 17 - Dominando los Fundamentos de MLS (en Espanol)

Eleva tu experiencia en bienes raíces con “Dominando los Fundamentos de MLS”, una clase diseñada meticulosamente para convertir el Servicio de Listado Múltiple en tu herramienta más poderosa. En este curso, desentrañarás las complejidades de MLS, aprendiendo a aprovechar todo su potencial para servir a tus clientes de manera efectiva y eficiente. Cubriremos los aspectos esenciales para navegar entre los listados, optimizar estrategias de búsqueda y dominar el arte de presentar datos que capturan la atención. Esto no se trata solo de entender un sistema; se trata de transformar la información en oportunidades y usar las percepciones de MLS para anticipar las tendencias del mercado.

Classes

Dec. 19 - Goal Setting for 2024

Step into 2024 with clarity and ambition as an expert instructor guides California REALTORS® on goal-setting. Rooted in the Tom Ferry approach to real estate, this session emphasizes envisioning success, crafting actionable milestones, and harnessing market trends. Attendees will be empowered to set, track, and achieve their aspirations, ensuring a prosperous year ahead. With Tom Ferry's proven strategies, 2024 promises to be a landmark year for every ambitious Californian REALTOR®. Snacks and drinks will be provided. Seating is limited. *Tom Ferry himself will not be present. The instructor is a certified Tom Ferry coach, trainer and instructor.

Classes

Dec. 27 - FlashCMA Webinar

Join 30-year California broker, national coach, and co-founder and developer of FlashCMA, Patrick Alexander, as he walks you through this exclusive SDAR member benefit, the unique CMA software being hailed as "America's most powerful CMA software in the USA.!"

Classes

Jan. 10 - California Contracts 2024

Step into the future of real estate transactions with "CA Contracts 2024," a comprehensive class designed specifically for California REALTORS® looking to navigate the evolving landscape of property agreements. As you immerse yourself in this course, you'll gain expert insights into the latest contractual changes, legal updates, and compliance practices that will become effective in 2024. With a focus on the practical application of these new standards, we'll prepare you to confidently draft contracts, while ensuring the utmost protection for your clients and your business. Whether you're a seasoned professional or just starting out, this class will equip you with the knowledge to lead in California's competitive real estate market.

Classes

New Agent Series

Introducing the "New Agent Series," the essential starting point for aspiring REALTORS® poised to make their mark in the real estate world. This course series is crafted to provide you with a solid foundation in the industry, offering a step-by-step guide through the core skills and knowledge every successful agent needs to master. From understanding market dynamics to developing a keen eye for property potential, we'll equip you with the confidence to navigate your first transactions with professionalism and ease. Connect with mentors and peers in an environment that's supportive, interactive, and focused on real-world application. Begin your journey with the "New Agent Series" and build the groundwork for a thriving, long-term career in real estate.

Classes

Jan. 17 - BRBC: Role-Playing for Success

Learn the art of setting fees that reflect your expertise and the services you provide, ensuring you're fairly compensated for your hard work. Discover effective strategies for interviewing potential clients and addressing their challenges and concerns. Understand how to articulate your unique value and services, effectively overcoming objections with confidence. Dive into the new vernacular of California real estate and acquire essential skills in risk management, problem-solving, contract negotiation, and more. Elevate your real estate career with this comprehensive course that equips you to thrive in the ever-evolving industry landscape.

Classes

Feb. 8 - Going Viral - Social Media Strategy

Unlock the secrets of social media success with "Going Viral," the must-attend class for realtors eager to amplify their online impact. In this engaging and impactful course, you'll learn to fine-tune your digital strategy, ensuring your real estate offerings don't just get seen - - they get shared. We'll guide you through the maze of algorithms and teach you the art of crafting magnetic content that resonates with your audience. Elevate your profiles and turn your online presence into a beacon for buyers and sellers alike. Don't just join the conversation: Lead it, and watch as your business thrives in the bustling world of social media.

Classes

Feb. 15 - The AI Age of Real Estate

Dive into this transformative class crafted for REALTORS® who are ready to harness the revolutionary power of artificial intelligence (AI) in their business strategy. This course will guide you through the latest AI tools and techniques that are reshaping the property market, ensuring your listings stand out in a competitive digital landscape. Learn how to automate your outreach, personalize client interactions, and analyze market data with precision -- all skills that will set you apart in the modern real estate industry. As you master these innovative solutions, you'll not only save time but also create more meaningful connections with buyers and sellers. Join us and be at the forefront of the AI revolution, where the future of real estate is not just predicted? It's already here.

Classes

Feb. 16 - REALTOR® Roundtable

Join the conversation at "REALTOR® Roundtable," where California's real estate professionals converge to sharpen their skills for the year ahead. This engaging class is a hub for collaboration, offering a deep dive into the state's latest real estate trends, legislation, and success strategies. Here, you'll exchange insights with peers, debate hot topics, and discover new approaches to common challenges in the ever-evolving property landscape. Each session is designed to empower you with practical knowledge and networking opportunities, ensuring you leave with a wealth of resources to elevate your practice. Whether you're looking to refine your expertise or expand your professional circle, this is your gateway to becoming a more informed and connected REALTOR® in 2024.

Events

Mastering Commercial Real Estate - 101

This course provides real estate agents with a comprehensive understanding of commercial real estate transactions.

Classes

Feb. 20 Webinar - NHS Pro: New Construction

Don't miss out on buyers looking for new home builds just because they think you cannot help them with new construction homes. You can! A free NHS Pro agent account gives you a free landing page called your Showingnew microsite. Also take advantage of the NewHomeSource Professional widget you can embed on your website. These tools direct buyers, who are interested in new communities, back to you as an expert in your market.

Classes

Feb. 23 Webinar - Get Paid What You're Worth!

Join us for a dynamic and captivating live webinar hosted by Jeff Mays of the Tom Ferry organization! Discover the secrets to turning potential leads into loyal, long-term clients who trust your expertise and rely on your services. Gain access to exclusive tools and strategies that will help you provide your buyers with a consultation experience that is second to none.

Classes

Feb. 22 - Going Viral: Instagram Breakdown

Unlock the secrets of social media success with "Going Viral," the must-attend class for realtors eager to amplify their online impact. In this engaging and impactful course, you'll learn to fine-tune your digital strategy, ensuring your real estate offerings don't just get seen - - they get shared. We'll guide you through the maze of algorithms and teach you the art of crafting magnetic content that resonates with your audience. Elevate your profiles and turn your online presence into a beacon for buyers and sellers alike. Don't just join the conversation: Lead it, and watch as your business thrives in the bustling world of social media.

Classes

Mar. 25 - New Agent Series

Introducing the "New Agent Series," the essential starting point for aspiring REALTORS® poised to make their mark in the real estate world. This course series is crafted to provide you with a solid foundation in the industry, offering a step-by-step guide through the core skills and knowledge every successful agent needs to master. From understanding market dynamics to developing a keen eye for property potential, we'll equip you with the confidence to navigate your first transactions with professionalism and ease. Connect with mentors and peers in an environment that's supportive, interactive, and focused on real-world application. Begin your journey with the "New Agent Series" and build the groundwork for a thriving, long-term career in real estate.

Classes

Feb. 28 - Unlocking the Power of the DISC Assessment

Delve into the world of the DISC assessment with instructor and business coach, Maryam Hibashi. The DISC assessment is a powerful tool that unveils the intricacies of interpersonal behavior, providing invaluable insights for success in the real estate industry. Through a captivating exploration of the four distinct personality styles - Drive, Influence, Support, and Clarity - you will gain a deeper understanding of yourself and others. With practical strategies to adapt your communication and interpersonal skills, you'll be equipped to connect more effectively with a diverse range of clients, enhancing your ability to build lasting relationships and secure lucrative deals.

Classes

Feb. 29 - VA Realtor Success

The VA Realtor Success workshop aims to equip real estate industry professionals with the knowledge and skills to effectively serve military personnel. The workshop covers key topics including understanding the military lifestyle and PCS (Permanent Change of Station) moves, navigating the VA home loan benefit, and establishing long-term relationships with clients through referrals.

Classes

Mar. 4 - The AI Age of Real Estate

Dive into this transformative class crafted for REALTORS® who are ready to harness the revolutionary power of artificial intelligence (AI) in their business strategy. This course will guide you through the latest AI tools and techniques that are reshaping the property market, ensuring your listings stand out in a competitive digital landscape. Learn how to automate your outreach, personalize client interactions, and analyze market data with precision -- all skills that will set you apart in the modern real estate industry. As you master these innovative solutions, you'll not only save time but also create more meaningful connections with buyers and sellers. Join us and be at the forefront of the AI revolution, where the future of real estate is not just predicted? It's already here.

Classes

Mar. 6 - My Favorite Ai Tools for Real Estate

As we embrace technological advancements, it's crucial to stay ahead of the curve. Marketing and technology consultant CJ Brogan presents an informative tech talk: "My Favorite AI Tools for Real Estate!" Learn about cutting-edge Ai tools transforming real estate marketing, lead generation, and customer engagement. CJ cuts through all of the Ai noise and chatter out there to cast a spotlight on the easiest, most relevant, and cost-effective Ai tools and options for real estate out there.

Classes

Mar. 12 - Tom Ferry Training: Secrets of Sales-Week 2

Join our 4-week series of dynamic sales classes, taught by a successful and active Tom Ferry Trainer, where you'll master the art of selling in today's fast-paced market. Dive deep into techniques and skills that top producers use to close deals effectively. Learn the secrets behind successful open house strategies and enhance your listing presentation skills to stand out from the competition. Discover the top negotiation tips that will give you the upper hand in any transaction. Become an appointment-setting machine and build a winning team that drives results. Explore the psychology and consumer behavior that drives purchasing decisions and harness technology and CRM systems for maximum efficiency. Lastly, supercharge your prospecting and lead generation efforts to ensure a steady stream of qualified leads. Don't miss this opportunity to elevate your sales game with insights from a Tom Ferry Trainer and achieve unprecedented success.

Classes

Aug 26 - BRBC Contract Update

Elevate your real estate expertise with "Understanding the BRBC Contract: New Forms" a detailed class designed for California REALTORS®. This course provides a deep dive into the latest changes to the Buyer Representation and Broker Compensation (BRBC) agreement. You'll gain valuable insights into new provisions, legal updates, and best practices that will be essential in 2024. Learn how these updates affect your client interactions and compensation structures. Stay informed and ahead in the ever-evolving California real estate market by mastering the latest developments in the BRBC contract.

Classes

Sep 4 - The Art & Science of the Ai Prompt

Get the most out of ChatGPT and gain invaluable insights into mastering the necessary components to use when prompting any AI platform. This session is designed for real estate professionals eager to elevate their online presence. Learn the secrets to creating engaging content, optimizing your channels for maximum visibility, and harnessing the power of AI. The instructor will share a new platform that is the “easy button” for ChatGPT with every component designed for real estate.

Classes

Sep 5 - zipForm: Focusing on the RLA & RPA

Learn the critical details of the Residential Listing Agreement (RLA) and Residential Purchase Agreement (RPA) forms. Each form will be given dedicated attention with approximately one hour of focused instruction, ensuring you gain a comprehensive understanding of these essential documents. Learn the nuances that will help you navigate your transactions with confidence and clarity. Whether you're new to these forms or looking for a refresher, this class will enhance your proficiency in managing real estate contracts. Don't miss this opportunity to elevate your expertise and better serve your clients.

Classes

Sep 6 - zipForm: Focusing on Buyer Forms

In this class, our contract expert will guide you through the essential buyer forms used in real estate transactions including the Buyer Representation and Broker Compensation Agreement (BRBC).. Each form will receive dedicated attention, ensuring you gain a comprehensive understanding of how to effectively utilize these documents in your practice. Learn the nuances that will help you manage your listings with confidence and precision. Whether you're new to these forms or seeking a refresher, this class will enhance your proficiency in handling buyer agreements. Elevate your expertise and better serve your clients through this targeted instruction.

Classes

Sep 10 - New Agent Training

In this comprehensive class, Rose Tsauga will guide you through the fundamentals of starting a successful real estate career. From understanding market dynamics to mastering client interactions, you'll gain the knowledge and skills necessary to thrive as a new agent. Rose's hands-on approach and practical advice will provide you with the confidence to hit the ground running and build a strong foundation for your career. Receive expert guidance from a seasoned professional.

Classes

Sep 11 - zipForm: Focusing on Listing Forms

In this class, our contract expert will guide you through the essential listing forms used in real estate transactions. Each form will receive dedicated attention, ensuring you gain a comprehensive understanding of how to effectively utilize these documents in your practice. Learn the nuances that will help you manage your listings with confidence and precision. Whether you're new to these forms or seeking a refresher, this class will enhance your proficiency in handling listing agreements. Elevate your expertise and better serve your clients through this targeted instruction.

Classes

Sep 12 - Property Management 101

This two-session class is for REALTORS® interested in expanding their property management expertise. Whether you're just beginning or have some experience, learn essential insights and practical tools and covers everything from tenant relations to financial management, equipping you to navigate the complexities of this field. Gain valuable knowledge to elevate your real estate business and confidently handle property management challenges. Ideal for those looking to deepen their understanding and enhance their professional skills.

Classes

Sep 13 - zipForm: Focusing on Buyer Forms

In this class, our contract expert will guide you through the essential buyer forms used in real estate transactions including the Buyer Representation and Broker Compensation Agreement (BRBC).. Each form will receive dedicated attention, ensuring you gain a comprehensive understanding of how to effectively utilize these documents in your practice. Learn the nuances that will help you manage your listings with confidence and precision. Whether you're new to these forms or seeking a refresher, this class will enhance your proficiency in handling buyer agreements. Elevate your expertise and better serve your clients through this targeted instruction.

Classes

Sep 17 - Unlocking ADU Potential (Part 1)

Attend an engaging and comprehensive class on Accessory Dwelling Units (ADUs), presented by Lisa De Jesus of ADU Gurus. This special event will be held in two informative sessions this June, designed to provide you with the essential knowledge and tools to navigate the exciting opportunities in ADU development. Whether you are interested in adding value to single-family parcels or exploring multi-family options, our expert presenters will guide you through the latest legislative updates, building requirements, and strategic considerations. Attending both sessions is crucial to gain a complete understanding and make the most of this growing trend in California real estate. Don't miss this opportunity to expand your expertise and stay ahead in the market!

Classes

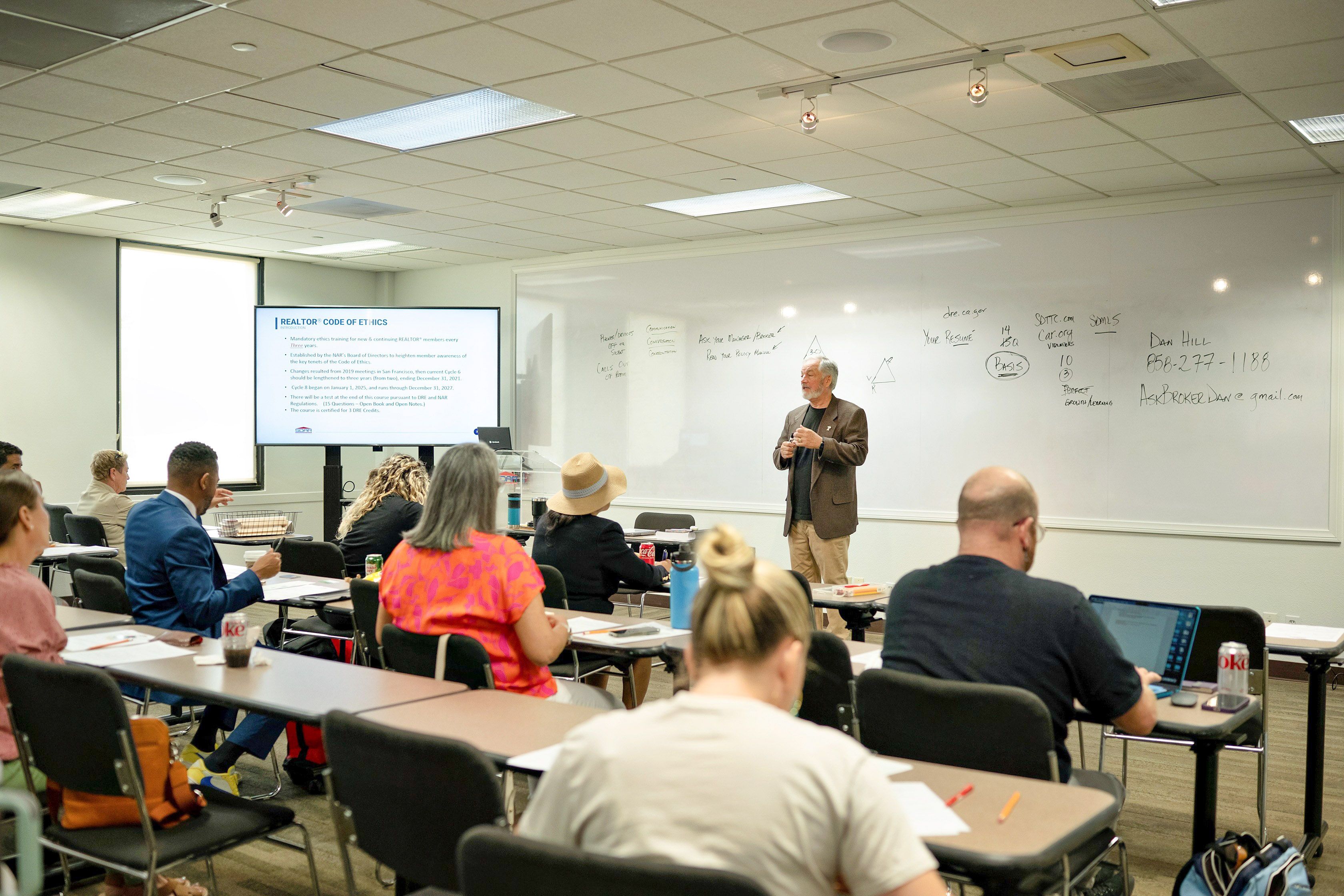

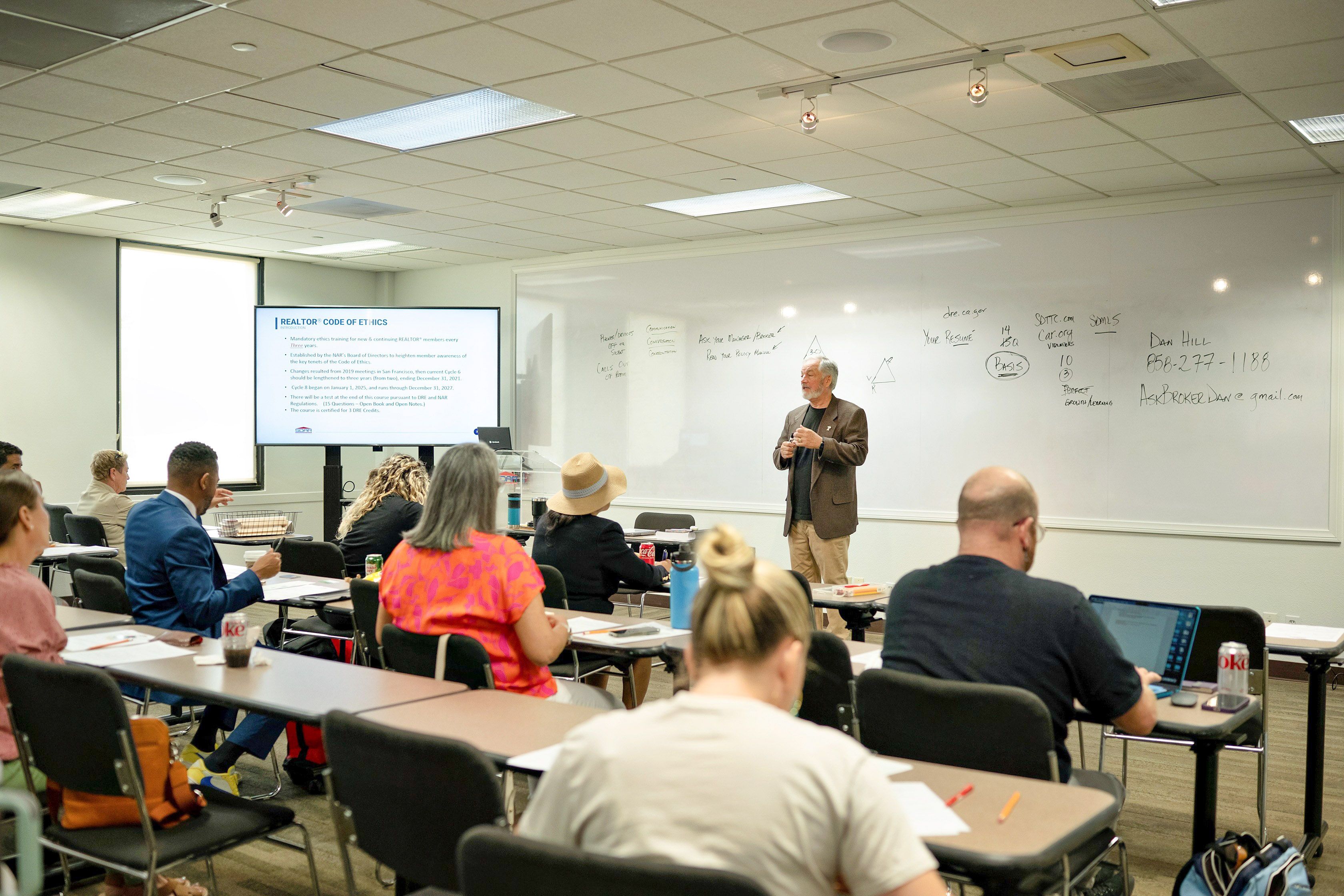

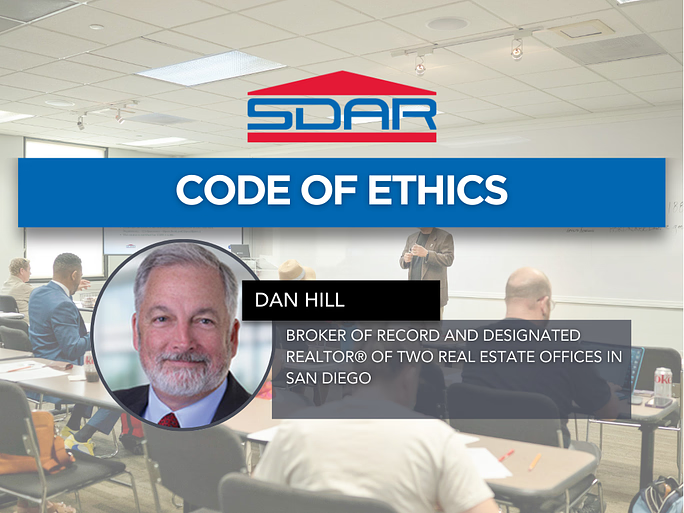

Sep 18 - Code of Ethics (Live in Kearny Mesa)

Based upon the NAR's Code of Ethics and Standards of Practice, learn about the standards of ethical conduct in the practice of real estate. This course also covers the California Business and Professions Code that guides ethical business practices within California. You will receive 3.00 of CE upon completion of the course and passage of the 15-question exam. Arrive 15 minutes early for registration and bring a government-issued ID for verification. Late registrants will not be allowed to enter the classroom. (DRE SPONSOR ID #0282)

Classes

Sep 18 Webinar - REALTOR® Safety Month

Meeting new clients and showing properties alone can pose safety risks. This webinar is designed to prioritize your personal safety by covering essential protocols for in-person showings and client meetings. You will learn to identify potential threats, leverage technology for safety, and effectively handle emergencies.

Classes

Sep 18 - zipForm: Focusing on the RLA & RPA

Learn the critical details of the Residential Listing Agreement (RLA) and Residential Purchase Agreement (RPA) forms. Each form will be given dedicated attention with approximately one hour of focused instruction, ensuring you gain a comprehensive understanding of these essential documents. Learn the nuances that will help you navigate your transactions with confidence and clarity. Whether you're new to these forms or looking for a refresher, this class will enhance your proficiency in managing real estate contracts. Don't miss this opportunity to elevate your expertise and better serve your clients.

Classes

Sep 19 - Time Management & Systems

Are you a REALTOR® looking to revolutionize your business and achieve unparalleled success? Join an exclusive class with Rose Tsauga, an acclaimed REALTOR® and time management coach, known for her transformative approach to business efficiency. Rose will share her expert strategies on mastering time management and implementing effective systems to streamline your workflow. Discover how to prioritize tasks, manage your schedule like a pro, and create systems that save you time and energy. These practical tips and proven techniques will not only enhance your productivity but also help you achieve a better work-life balance.

Classes

Sep 20 - Reverse Mortgages

Whether you're new to the concept or looking to deepen your understanding, this session will provide you with the essential information you need to navigate reverse mortgages confidently. Break down the complexities of how reverse mortgages work, the benefits they offer, and the key considerations for clients considering this option. Enhance your expertise and learn how to effectively guide your clients through the reverse mortgage process. This class is an invaluable opportunity to expand your knowledge and better serve your clients' financial needs.

Classes

Sep 23 - Reading a Prelim

Understanding how to read a preliminary report is crucial for navigating real estate transactions effectively. In this class, hosted by Ticor Title, you'll gain valuable insights into interpreting the key elements of a prelim, ensuring you can identify potential issues and protect your clients' interests. Whether you're a seasoned professional or new to the process, this session will enhance your ability to analyze title reports with confidence and accuracy. Learn from experts at Ticor Title and sharpen your skills to better support your clients in every transaction. Don't miss this opportunity to deepen your knowledge and expertise.

Classes

Sep 24 - New Agent Training

In this comprehensive class, Rose Tsauga will guide you through the fundamentals of starting a successful real estate career. From understanding market dynamics to mastering client interactions, you'll gain the knowledge and skills necessary to thrive as a new agent. Rose's hands-on approach and practical advice will provide you with the confidence to hit the ground running and build a strong foundation for your career. Receive expert guidance from a seasoned professional.

Classes

Sep 26 - Time Management & Systems

Are you a REALTOR® looking to revolutionize your business and achieve unparalleled success? Join an exclusive class with Rose Tsauga, an acclaimed REALTOR® and time management coach, known for her transformative approach to business efficiency. Rose will share her expert strategies on mastering time management and implementing effective systems to streamline your workflow. Discover how to prioritize tasks, manage your schedule like a pro, and create systems that save you time and energy. These practical tips and proven techniques will not only enhance your productivity but also help you achieve a better work-life balance.

Classes

Sep 27 - California Prop 33: Rent Control

Gain a comprehensive understanding of California Proposition 33 in this informative session presented by the Southern California Rental Housing Association. Delve into the details of the rent control legislation to gain insights to navigate its impact on the rental market. The instructor will break down the complexities of the law, offering practical guidance on how it affects landlords, tenants, and the broader real estate landscape. Whether you're a property manager, landlord, or agent, this session will equip you with the knowledge to stay ahead in the evolving rental market.

Classes

Sep 28 & 29 - Real Estate Exam Prep Crash Course

This two-day Crash Course & Exam Prep package from SDAR partner California Realty Training is proven to help you pass the state exam on your very first try! They have a 90% pass rate based on students who’ve followed the state exam prep recommendation. Enter promo code SDAR24 at checkout to receive a 20% Discount! While the Crash Course & Exam Prep packages do not qualify you to take the state exam; you must complete 3 pre-licensing courses first before you can apply for the exam and your license. All of the pre-licensing packages include a state exam prep and special discount pricing on the crash course.

Classes

Sep 30 - zipForm: Focusing on Buyer Forms

In this class, our contract expert will guide you through the essential buyer forms used in real estate transactions including the Buyer Representation and Broker Compensation Agreement (BRBC).. Each form will receive dedicated attention, ensuring you gain a comprehensive understanding of how to effectively utilize these documents in your practice. Learn the nuances that will help you manage your listings with confidence and precision. Whether you're new to these forms or seeking a refresher, this class will enhance your proficiency in handling buyer agreements. Elevate your expertise and better serve your clients through this targeted instruction.

Classes

Oct 4 - Mastering the Residential Purchase Agreement

Unlock the full potential of your real estate transactions by mastering the Residential Purchase Agreement (RPA) with Luis Garcia, an expert REALTOR® and certified forms trainer. In this hands-on session, you’ll learn how to navigate the RPA with confidence, ensuring your clients' interests are protected while staying compliant with California real estate laws. Luis will break down complex sections of the form, providing insider tips on how to fill it out efficiently and effectively.

Classes

Oct 9 - The ABCs and 123s of Canva

Are you ready to elevate your marketing game to the next level? Buckle up because we're diving into the world of Canva, your ultimate tool for creating eye-catching visuals that'll make your listings shine like never before! In this fun and interactive class, we'll take you from Canva newbie to design pro in no time. Whether you're a tech-savvy agent or a total beginner, we've got you covered.

Classes

Oct 14 - Building Strong Teams: Strategies for Success

This class explores key strategies for fostering a cohesive, productive team environment, where collaboration and communication excel. Instructor Zandra Ulloa shares expert insights on identifying strengths within your team, delegating tasks effectively, and maintaining motivation for sustained success. Whether you’re forming a new team or refining an existing one, this course offers valuable tools to enhance leadership and team dynamics. Gain actionable strategies to create a thriving team culture that drives exceptional results!

Classes

Oct 15 - Property Management Tips

Attend this “Lunch & Learn” event featuring WeLease Property Management covering essential topics such as maintenance management, effective tenant screening, and strategies for dealing with difficult tenants. You’ll also learn about the latest legal essentials in property management to ensure compliance and protect your investments. Enhance your skills and network with fellow professionals in this engaging and informative session. Lunch and drinks provided.

Classes

Oct 16 - Code of Ethics (SOLD OUT)

Based upon the NAR's Code of Ethics and Standards of Practice, learn about the standards of ethical conduct in the practice of real estate. This course also covers the California Business and Professions Code that guides ethical business practices within California. You will receive 3.00 of CE upon completion of the course and passage of the 15-question exam. Arrive 15 minutes early for registration and bring a government-issued ID for verification. Late registrants will not be allowed to enter the classroom.

Classes

Oct 21 - PalmAgent ONE - Additional Features

Discover how to make the most out of PalmAgent ONE, the industry's #1 net sheet and closing cost app. This powerful tool is not only fast and user-friendly but also packed with features designed to help you connect with buyers and sellers more effectively. You'll learn to create and share visually stunning net sheets effortlessly. Master the art of dynamic seller net sheets, buyer estimates, and monthly affordability presentations to enhance your client interactions.

Classes

Oct 22 - Property Management 102

This two-session class is for REALTORS® interested in expanding their property management expertise. Whether you're just beginning or have some experience, learn essential insights and practical tools and covers everything from tenant relations to financial management, equipping you to navigate the complexities of this field. Gain valuable knowledge to elevate your real estate business and confidently handle property management challenges. Ideal for those looking to deepen their understanding and enhance their professional skills.

Classes

Oct 23 - San Diego County Housing Forecast

In this session, discover the secrets behind the unpredictable real estate market; uncover the mysteries of where home values are headed, and gain insights that will make you a savvy agent. Position your clients for financial success in the housing market. Finally, don't miss the chance to answer the burning question, "Will buyers ever have the upper hand?" as we unravel the market dynamics together.

Classes

Oct 28 - Down Payment Assistance Program

Help clients purchase homes using available down payment assistance programs. This course, led by Juanita Villalvazo, a HUD Certified Housing Counselor with over 40 years of experience at the SDHC, will cover programs like the SDHC First-Time Homebuyer Program, which offers deferred-payment loans, closing cost assistance grants, and mortgage credit certificates. Discover how to leverage these programs for your buyers and become a valuable resource in the home-buying process. This informative two-hour session is expected to be highly popular, so secure your spot quickly. Don't miss this opportunity to enhance your expertise and support your clients effectively.

Classes

Oct 29 - Commercial Real Estate Property Types

This course aims to equip participants with the knowledge needed to understand, evaluate, and invest in different categories of commercial properties. The course is suitable for aspiring commercial real estate agents, investors, industry professionals, and anyone interested in gaining a deeper understanding of commercial real estate. Learn the fundamentals and types of commercial real estate, gain insights into market trends and valuation techniques, develop strategies for investing in and managing different property types, and analyze risks and opportunities in commercial real estate investments.

Classes

Oct 29 - Building Strong Teams: Strategies for Success

This class explores key strategies for fostering a cohesive, productive team environment, where collaboration and communication excel. Instructor Zandra Ulloa shares expert insights on identifying strengths within your team, delegating tasks effectively, and maintaining motivation for sustained success. Whether you’re forming a new team or refining an existing one, this course offers valuable tools to enhance leadership and team dynamics. Gain actionable strategies to create a thriving team culture that drives exceptional results!

Classes

Oct 31 - Conquering Contracts: Get Your BRBC Signed

Elevate your real estate expertise with "Conquering Contracts: Get Your BRBC Signed," a detailed class designed for California REALTORS®. This course provides a deep dive into the latest changes to the Buyer Representation and Broker Compensation (BRBC) agreement. You'll gain valuable insights into new provisions, legal updates, and best practices that will be essential in 2024. Learn how these updates affect your client interactions and compensation structures. Stay informed and ahead in the ever-evolving California real estate market by mastering the latest developments in the BRBC contract.

Classes

Nov 5 - Creating Newsletters in Canva

Whether you're new to Canva or looking to sharpen your design skills, this class will cover everything you need to know to create engaging newsletters that captivate your audience. You’ll learn how to navigate Canva’s user-friendly design tools, as well as best practices for layout, typography, and visuals to make your newsletters stand out. By the end of this session, you'll walk away with a stunning newsletter template ready to use for your next campaign!

Classes

Nov 6 - The RLA and Open House Procedures

Scott Vinson II, an experienced broker and REALTOR®, leads this powerful class on delivering winning listing presentations and mastering the Residential Listing Agreement (RLA). Also covered are open house procedures with the OHNA and BNA forms, and how to navigate them. You'll learn how to present yourself as the top choice for potential sellers while ensuring you secure your rightful compensation. Scott will break down the essential elements of the RLA and share expert insights on how to position yourself for success during negotiations. Elevate your listing presentation skills and confidently handle compensation discussions with every client.

Classes

Nov 7 - Property Management 101

This two-session class is for REALTORS® interested in expanding their property management expertise. Whether you're just beginning or have some experience, learn essential insights and practical tools and covers everything from tenant relations to financial management, equipping you to navigate the complexities of this field. Gain valuable knowledge to elevate your real estate business and confidently handle property management challenges. Ideal for those looking to deepen their understanding and enhance their professional skills.

Classes

Nov 8 - The BRBC and Negotiation Skills for Compensation

Join experienced instructor and broker Justin DeCesare for an in-depth course on the BRBC and essential strategies for negotiating compensation. You’ll learn how to effectively navigate the complexities of the Buyer Representation Agreement and confidently secure your compensation in every transaction. Justin’s extensive knowledge will equip you with proven techniques to protect your value as a REALTOR® and ensure you maximize your earnings. Don’t miss this opportunity to enhance your expertise and increase your success in real estate!

Classes

Nov 12- Property Management 102

This two-session class is for REALTORS® interested in expanding their property management expertise. Whether you're just beginning or have some experience, learn essential insights and practical tools and covers everything from tenant relations to financial management, equipping you to navigate the complexities of this field. Gain valuable knowledge to elevate your real estate business and confidently handle property management challenges. Ideal for those looking to deepen their understanding and enhance their professional skills.

Classes

Nov 13 - Disclosures: Protecting Yourself & Your Clients

Join experienced instructor and REALTOR Karen Van Ness, well-versed in forms and contracts, for an essential class on real estate disclosures. This course will guide REALTORS through the critical disclosure forms, ensuring you understand the legal responsibilities and potential liabilities that come with them. Navigate the intricacies of property condition reports, seller disclosures, and more, giving you the confidence to handle disclosures effectively and transparently. Equip yourself with the knowledge to protect your clients and your business by mastering every aspect of the disclosure process.

Classes

Nov 14 - Reverse Mortgage

Discover the intricacies of reverse mortgages in this comprehensive class led by knowledgeable instructor Kathy Strong Collins. Whether you're new to the concept or looking to deepen your understanding, this session will provide you with the essential information you need to navigate reverse mortgages confidently. Kathy will break down the complexities of how reverse mortgages work, the benefits they offer, and the key considerations for clients considering this option. Enhance your expertise and learn how to effectively guide your clients through the reverse mortgage process.

Classes

Nov 15 - The BRBC and Negotiation Skills for Compensation

Join experienced instructor and broker Justin DeCesare for an in-depth course on the BRBC and essential strategies for negotiating compensation. You’ll learn how to effectively navigate the complexities of the Buyer Representation Agreement and confidently secure your compensation in every transaction. Justin’s extensive knowledge will equip you with proven techniques to protect your value as a REALTOR® and ensure you maximize your earnings. Don’t miss this opportunity to enhance your expertise and increase your success in real estate!

Classes

Nov 18 & 19 - Accredited Buyer Rep Designation Course

SDAR is sponsoring this 2-day course taught by certified instructor and SDAR member Ginni Field. This sought-after NAR designation, typically valued at approximately $600, is offered to our members at no cost! The course is specifically designed to help you: Conduct a buyer counseling session; sign buyer clients to a written buyer representation agreement; negotiate buyer clients’ offers; and bring the transaction to a successful close. Completing this course is the first step to earning the ABR designation.

Classes

Nov 19 - PalmAgent ONE - Additional Features

Discover how to make the most out of PalmAgent ONE, the industry's #1 net sheet and closing cost app. This powerful tool is not only fast and user-friendly but also packed with features designed to help you connect with buyers and sellers more effectively. You'll learn to create and share visually stunning net sheets effortlessly. Master the art of dynamic seller net sheets, buyer estimates, and monthly affordability presentations to enhance your client interactions.

Classes

Nov 21 - The RLA and Open House Procedures

Scott Vinson II, an experienced broker and REALTOR®, leads this powerful class on delivering winning listing presentations and mastering the Residential Listing Agreement (RLA). Also covered are open house procedures with the OHNA and BNA forms, and how to navigate them. You'll learn how to present yourself as the top choice for potential sellers while ensuring you secure your rightful compensation. Scott will break down the essential elements of the RLA and share expert insights on how to position yourself for success during negotiations. Elevate your listing presentation skills and confidently handle compensation discussions with every client.

Classes

Nov 22 - The BRBC and Negotiation Skills for Compensation

Join experienced instructor and broker Justin DeCesare for an in-depth course on the BRBC and essential strategies for negotiating compensation. You’ll learn how to effectively navigate the complexities of the Buyer Representation Agreement and confidently secure your compensation in every transaction. Justin’s extensive knowledge will equip you with proven techniques to protect your value as a REALTOR® and ensure you maximize your earnings. Don’t miss this opportunity to enhance your expertise and increase your success in real estate!

Classes

Dec 2 - New Member Orientation

Are you a newly licensed real estate agent? If you are fresh out of real estate school, you are probably thrilled that you passed the test and found a great broker, but have no idea what to do next! Join us for our live New Member Orientation at our Kearny Mesa office features training on what you need to know to get started, the benefits of your SDAR member products and services, and lunch provided by the top real estate affiliates.

Classes

Dec 16 - Down Payment Assistance Program

Help clients purchase homes using available down payment assistance programs. This course, led by Juanita Villalvazo, a HUD Certified Housing Counselor with over 40 years of experience at the SDHC, will cover programs like the SDHC First-Time Homebuyer Program, which offers deferred-payment loans, closing cost assistance grants, and mortgage credit certificates. Discover how to leverage these programs for your buyers and become a valuable resource in the home-buying process. This informative two-hour session is expected to be highly popular, so secure your spot quickly. Don't miss this opportunity to enhance your expertise and support your clients effectively.

Classes

Dec 18 - Code of Ethics (Live in Kearny Mesa)

Based upon the NAR's Code of Ethics and Standards of Practice, learn about the standards of ethical conduct in the practice of real estate. This course also covers the California Business and Professions Code that guides ethical business practices within California. You will receive 3.00 of CE upon completion of the course and passage of the 15-question exam. Arrive 15 minutes early for registration and bring a government-issued ID for verification. Late registrants will not be allowed to enter the classroom. (DRE SPONSOR ID #0282)

Classes

Feb. 14 Webinar - NHS Pro Advanced: New Builds

Don't miss out on buyers looking for new home builds just because they think you cannot help them with new construction homes. You can! A free NHS Pro agent account gives you a free landing page called your Showingnew microsite. Also take advantage of the NewHomeSource Professional widget you can embed on your website. These tools direct buyers, who are interested in new communities, back to you as an expert in your market.

Classes

Code of Ethics (Cycle 8)

NAR's Code of Ethics, adopted in 1913, was one of the first codifications of ethical duties adopted by any business group. The Code ensures that consumers are served by requiring REALTORS® to cooperate with each other in furthering clients' best interests. REALTORS® are required to complete ethics training of not less than 2 hours and 30 minutes of instructional time. The training must meet specific learning objectives and criteria established by the National Association of REALTORS®.

Classes

Buyer Consultation 16 January 2025: Time 11am-1pm

Learn how to deliver consultations that convert, setting expectations and building trust from the first interaction.

Classes

Listing Presentation 23 January 2025

Develop a winning presentation strategy that gets listings every time, emphasizing your expertise and client-focused approach.

Classes

Open House Procedures 30 January 2025: Time 11am -1pm